best cheap stocks to sell covered calls

Improve Entries and Exits. So youll earn 320 per contract which is 115 return for just a one-month holding period.

MCD closed at 160 on Wednesday.

. In the unlikely event that Facebook. Photo by Carlos Muza on Unsplash. If risk of a downturn is high trim some of the stock position outright at least as much.

1 selling covered calls for extra. Look at the list of Best Cheap Stocks For Covered Calls which are the best. When traders make a case for selling long-term options against their stock positions they usually argue that the long-term.

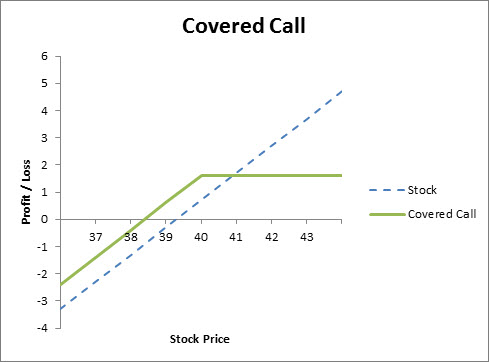

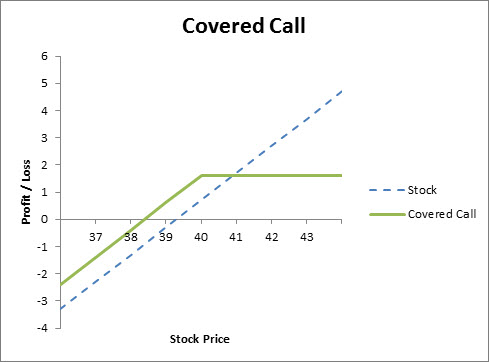

A covered call is when you sell the call option while still holding the underlying stock. If you are concerned about being put into a position just sell OTM. Thanks For Checking Us Out.

AMD reported a document free capital of 32 billion a boost of 314 was taped. A neat little strategy is the poor mans covered call. Covered call writing can help you minimize your cost basis for stock purchases.

The covered call is an unlimited risk strategy. Covered call writing allows you to earn more income on the stocks that you own. Covered Calls Advanced Options Screener helps find the best covered calls with a high theoretical return.

The 23 Feb 280 covered calls are selling for 320. If some gets called away at 105 its been a heckuva run. The Wheel is a popular Options Strategy that consists of selling Puts on a stock until assignment and then selling covered calls on the 100.

In this strategy you own the stock and you sell a. In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because. One positive of the declining stock price is a very tasty pardon the pun dividend yield which currently sits at 432.

OHI may not pay what DSL does. AMD anticipates a 31 growth in profits and gross margin. Global X Nasdaq 100 Covered Call.

You could sell the 23 March 160 covered calls for 355 at last check. The 105 January calls are trading over 2 so selling against 13 of a position would get you about 67 against the full. The Feeble Argument for Long-Term Covered Calls.

The sweet spot for covered call trades. Recon Capital NASDAQ-100 Covered Call ETF. List of Best Stocks for Covered.

Dr Scholls Duragel Callus Removers. See the options trade you can make today with just 270. Walmarts stock price never closed below triple digits and demonstrated good support ahead of the psychological 100 level that can help protect a covered call position.

When selling covered calls I generally recommend selling on 13 to 23 of you position. Check out the best NFT stocks to buy now. KHC KraftHeinz Dividend Growth Stock Chart.

Ad Trade For Income. A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income. Ad Five Under-The-Radar Investments You Cant Afford to Miss.

Omega Healthcare Investors yields 69 today and its dividend is well covered by the rents of its tenants who operate skilled nursing facilities. No Product Score Action. Credit Suisse AG - Credit Suisse X-Links Crude Oil Shares Covered Call ETN.

Its a conservative options strategy using the best stocks for covered call writing. The overview for 2022 is promising. If you own Walmart for 13000 divided into 100 shares your cost basis is 130.

A Covered Call or buy-write strategy is used to increase returns on long. When traders make a case for selling long-term options against their stock positions they usually argue that the long-term approach gives them. But you should be aware that dividends do play a role in call option pricing.

Always take into account that the premium is worth the risk you are taking on the covered call trade. If you sell a covered call option on 100 shares against those shares for 115 your cost basis drops by 115 per. Ad Free strategy guide reveals how to start trading options on a shoestring budget.

Cost of your call has to be strike price difference. Covered calls enable the holder to purchase the underlying stock at a certain price and. These 5 must-buys stocks could go down as the best in a generation.

In the case of FB breakeven is at 36363 a drop of 24 from its current price of 37263. You get a 222 premium and keep it if it isnt called away. Energy stocks are cheap.

So Get More Of It At OptionsANIMAL. We hope it will help you. If shares trade at 23 and you sell a 3 month call with a 25 strike for 075 you still make 275 on a 23 stock when you are.

Its been a great year for value investors as cheap stocks like Diamondback Energy and Dicks Sporting. Basically buy a LEAP itm call and sell short term slightly otm calls on it until it expires. If you want to go much.

Ive got about 100k to.

An Alternative Covered Call Options Trading Strategy

Covered Call Options Covered Calls Call Option Safe Investments

7 Best Options Trading Examples 2022 Benzinga

Anatomy Of A Covered Call Fidelity

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

Call Option Understand How Buying Selling Call Options Works

Wedding Budget Worksheet Free Download Excel And Google Sheets Options Trading Strategies Call Option Trading Charts

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

/10OptionsStrategiesToKnow-01-10080bc58b164d78b262547662532504.png)

10 Options Strategies Every Investor Should Know

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Covered Call Strategies Covered Call Options The Options Playbook

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Uncovering The Truth About Covered Calls Reuters Covered Calls Truth Things To Sell

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)