nebraska inheritance tax rates

The average effective rate averages 175 to 2 placing it in the top 10 highest in the nation. There are only six states in the nation that levy an inheritance tax and Nebraska is one of them.

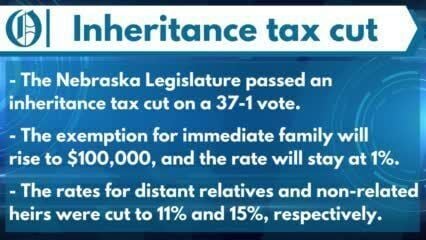

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com

This 1 rate applies to children.

. Anything above 15000 in value is subject to a 13 inheritance tax. Add the base payment to that figure and your total tax bill comes to 3073800 for this estate. That exemption amount and the underlying inheritance tax rate varies based on the inheritance.

County of Box Butte 169 Neb. Click here for all current and prior IRS revenue rulings. If the same rate is in effect for more than one month the link provided above is to the first IRS revenue ruling for that period.

Nebraska Gift Tax Inheritance Tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. 311 99 NW2d 245 1959.

FEDERAL ESTATE TAX RATES. The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023. Feb 11 2022 Updated Mar 21 2022.

Nebraska inheritance tax rate. Inheritance Tax Rates by State Ranked by Bracket ChildRateNephewNiece Non-RelativeRate Rate 1. 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests.

All Major Categories Covered. For purpose of inheritance tax property should be valued at amount of money which it would produce if offered and sold for cash at time of death of decedent. Nebraska inheritance tax is computed on the fair market value.

REG-17-001 Scope Application and Valuations. Ive got more good news for you. Although Nebraska no longer has an estate tax it is one of seven states that imposes a separate state inheritance tax.

Who are the remaining persons receiving inheritances. Nebraska is currently one of six states that imposes an inheritance tax when a resident of the state passes away. Currently the first 15000 of the inheritance is not taxed.

The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. Select Popular Legal Forms Packages of Any Category. Proceedings for determination of.

Who are the remaining persons receiving inheritances. Up to 25 cash back Close relatives pay 1 tax after 40000. Currently the first 15000 of the inheritance is not taxed.

Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount which ranges between 10000 and 40000. In fact Nebraska has the highest top rate at 18. Both the exempt amount and the rate of inheritance tax varies according to the degree of relationship between the decedent and the beneficiary receiving the inheritance as follows.

Nebraska inheritance tax rates If you were the decedents parent grandparent sibling child. Nebraska Legislature passes inheritance tax cut. For transfers to immediate family members not including spouses the inheritance tax rate is 1 on the value of the property that passes to each person over an exemption amount of 40000 per person.

An inheritance by the widower of a daughter is not taxable at the rate prescribed by this section. Beyond that the Nebraska inheritance tax is as follows. Anything above 15000 in value is subject to a 13 inheritance tax.

If they inherit more than 40000 a 1 tax will apply to the amount over the first 40000. How is this changed by LB310. Here are Nebraskas inheritance tax rates and exemption amounts.

A practitioner should also note that for inheritance tax purposes Nebraska law will treat as a child of the decedent any person to whom the deceased for not less than 10 years prior to. Until this TABLE 1. In all proceedings for the determination of inheritance tax the following deductions from the value of the property subject to Nebraska inheritance taxation shall be allowed to the extent paid from chargeable to paid payable or expected to become payable with respect to property.

In other words they dont owe any tax at all unless they inherit more than 40000. The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023. Transfers to immediate family members other than the surviving spouse -- The tax rate on transfers to immediate relatives eg children grandchildren siblings parents etc will remain 1 however the exemption amount will increase from 40000 to 100000 per beneficiary.

All taxes imposed by sections 77-2001 to 77-2037 unless otherwise herein provided for shall be due and payable twelve months after the date of the death of the decedent and interest at the rate specified in section 45-10401 as such rate may from time to time be adjusted by the Legislature shall be. Nebraska does not have a gift tax. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

You are in the highest tax bracket and you owe a 345800 base payment on the first 1 million of your estate. The inheritance tax must be paid within 12 months of the date of death otherwise interest accrues at 14 with penalties of 5 per month up to 25 of the tax due. For all other beneficiaries Class 3 the rate of tax is 18 percent on the value of the property in excess of 10000.

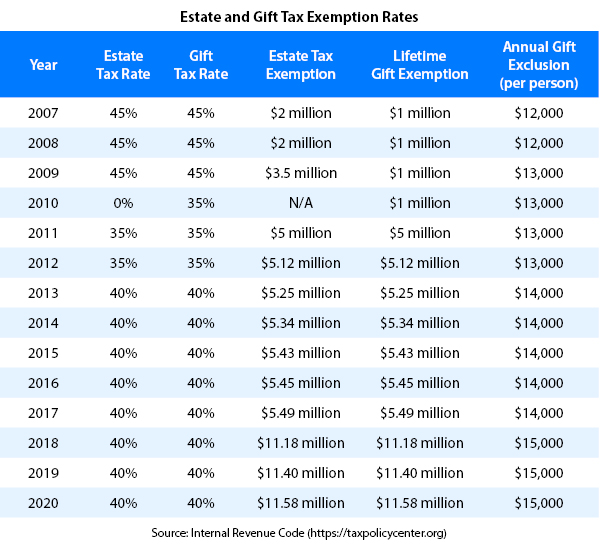

You also owe 40 of the remaining 682 million which comes to 2728 million. The federal gift tax allows a 15000 exemption amount per year and per person. For states to immediately amend their inheritance tax laws into progressive structures and many states that had not yet levied the tax added it to their tax rolls.

How to Legally Avoid the Oregon Estate Tax Top. According to a local law firm When a person dies a resident of Nebraska or with property located in Nebraska the Nebraska county inheritance tax will likely apply to the decedents property. LINCOLN Nebraska lawmakers passed a.

How is this changed by LB310.

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com

Inheritance Tax Guide Know Better Plan Better

Can Making Lifetime Gifts Really Reduce Your Tax Liability In The Future

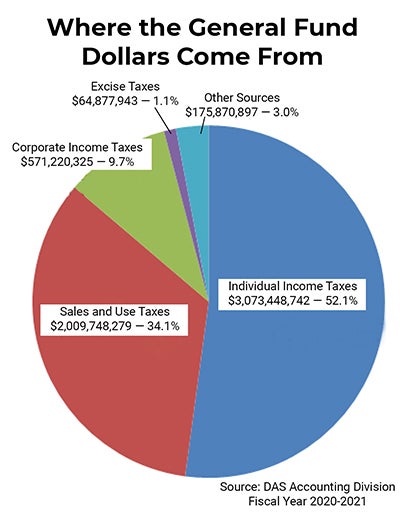

Nebraska Income Tax Calculator Smartasset

Annuity Taxation How Various Annuities Are Taxed

Can Making Lifetime Gifts Really Reduce Your Tax Liability In The Future

Is Your Inheritance Considered Taxable Income H R Block

Nebraska Income Tax Calculator Smartasset

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com

The Most Tax Friendly States For Retirees Vision Retirement

Nebraska Lawmakers Pass Tax Cut Measure Nebraska Thecentersquare Com

The Truth About Inheritance Tax Updated 2020 Trust Will

Nebraska S Estate Plan For Your Farm Cropwatch University Of Nebraska Lincoln

States With Inheritance Tax Gobankingrates

The Truth About Inheritance Tax Updated 2020 Trust Will

Annuity Taxation How Various Annuities Are Taxed

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com